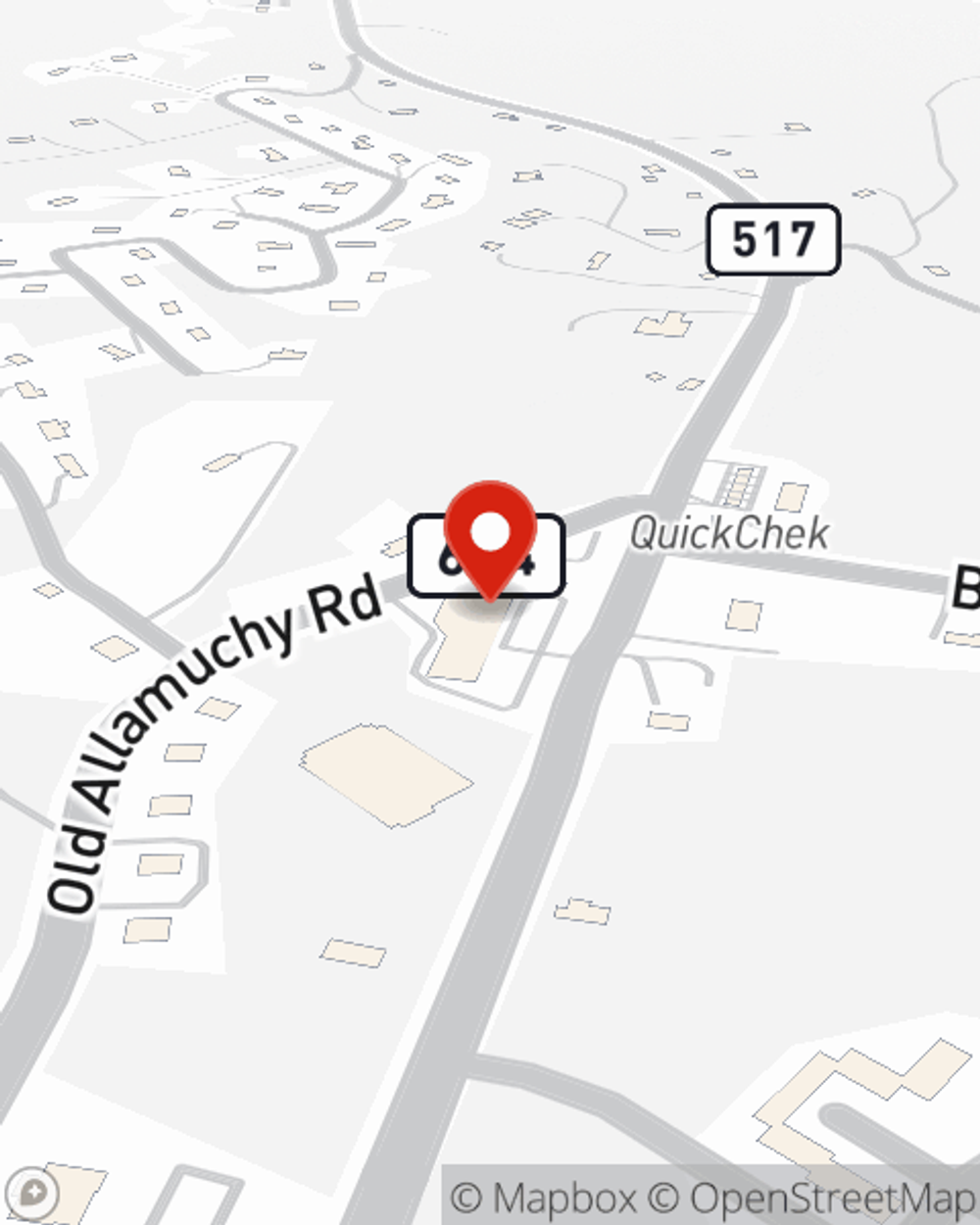

Business Insurance in and around Hackettstown

Looking for small business insurance coverage?

Insure your business, intentionally

- Hackettstown

- Independence

- Alllamuchy

- LongValley

- Andover

- Washington

- Great Meadows

- Califon

- Panther Valley

- Mansfield

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to consider. We get it. State Farm agent Jim Malay is a business owner, too. Let Jim Malay help you make sure that your business is properly protected. You won't regret it!

Looking for small business insurance coverage?

Insure your business, intentionally

Small Business Insurance You Can Count On

For your small business, whether it's a dry cleaner, a tailoring service, a toy store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like equipment breakdown, business property, and extra expense.

At State Farm agent Jim Malay's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Jim Malay

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.